Tax on super-rich to stay

Ravi Shanker Kapoor | July 21, 2019 12:05 am

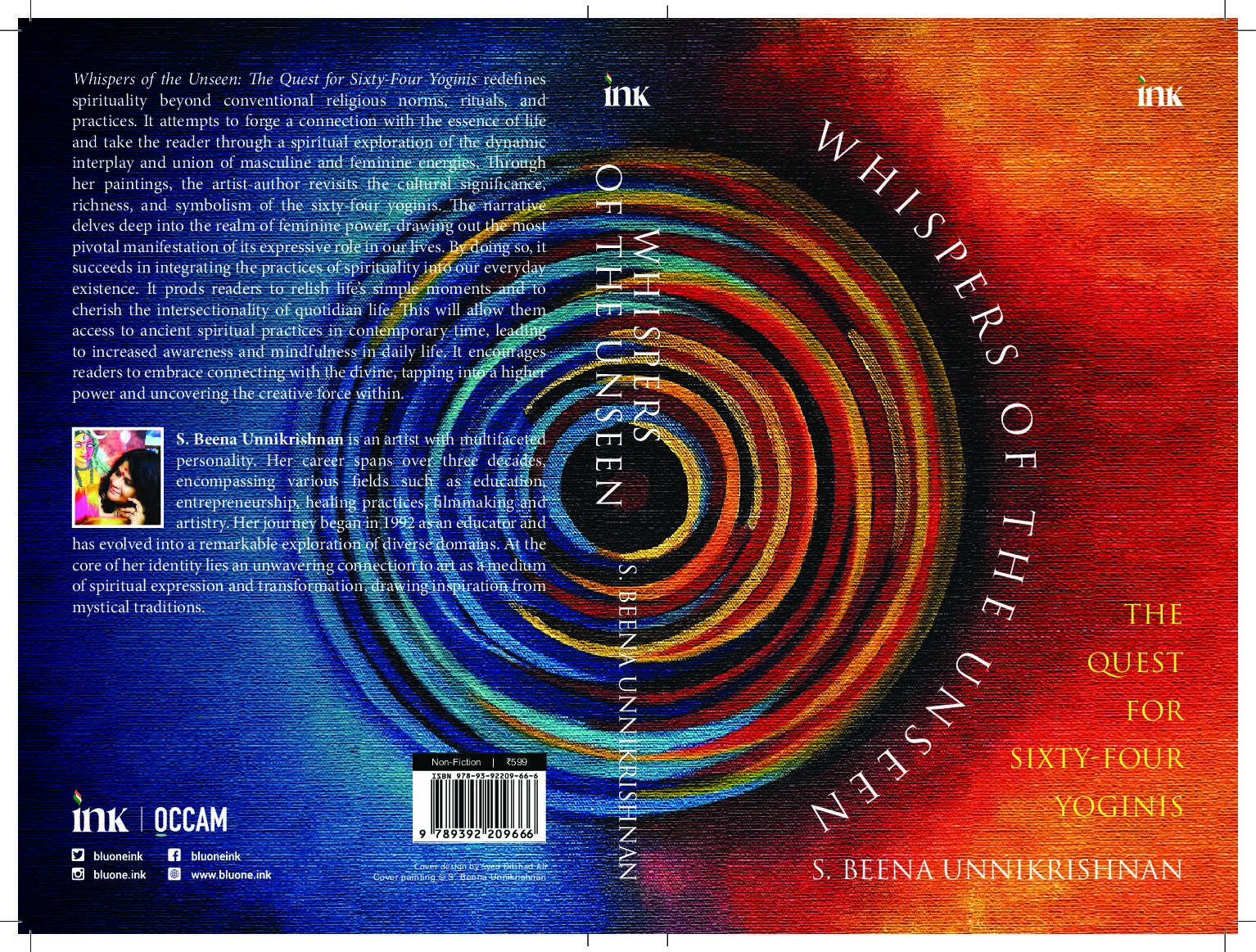

Secretary of Defense Jim Mattis meets with India's Defence Minister Nirmala Sitharaman in New Delhi on Sept. 26, 2017. (DOD photo by U.S. Air Force Staff Sgt. Jette Carr)

By refusing to withdraw the tax on the super-rich, Finance Minister Nirmala Sitharaman has affirmed her faith in the chief tenet of the economic philosophy practiced by the Nehru-Gandhi Dynasty: you can remove poverty by distributing the wealth of the rich among the poor.

This tax is but a small expectation from the rich to contribute a little more for the poor, she said at the International Business Conference in Chennai yesterday. She added that “not more than 5,000 people are there in the super rich category in the country and the Union Budget 2019-20 has several measures to help start-ups,” reported the news agency IANS.

The super-rich ought to shoulder part of the government’s responsibility in supporting the poor, she said, adding that it is not highway robbery or done with the intention to affect their business. Well, Madam Minister, is it the responsibility of the government to support the poor in the first place?

Now, this may sound terribly anti-poor to question poverty eradication, but the truth is that when government in India decides to end poverty, it actually perpetuates it. This happened with Indira Gandhi’s garibi hatao stunt; the Narendra Modi government’s populism in the last five years has already adversely affected growth and employment; if he remains focused on garibi hatao, worse may follow.

Sadly, he and his government don’t want to see anything beyond poverty. Hence the pathetic Budget Sitharaman came up with. And hence the socialist rhetoric.

In her budget, she had raised the income tax surcharge on taxpayers with income in the Rs 2-5 crore bracket from 15 per cent to 25 per cent, and from 15 per cent to 37 per cent for those earning more. This meant that the effective tax rates for those two groups would now be 39 per cent and 42.74 per cent, respectively.

The tax was resented by a large section of foreign portfolio investors (FPIs), but she has rejected their pleas.

In Chennai, she was reiterating what she had said earlier in her reply to the discussion in the Lower House on the Bill: “The essence of the taxation proposals in the Finance Bill are meant to promote ease of doing business, encouraging Make in India and encouraging young entrepreneurs, who want to invest their own seed capital. That is the drive that Make in India needs now, because there is a lot of enthusiasm among people who want to move from being in a salaried job to creating jobs for others.”

It is a well-known fact that the rich are leaving India; in the last three years alone, as many as 18,000 have migrated to the countries that offer better working and living conditions. This quit-India movement may intensify. But this doesn’t bother the Finance Minister. Apparently, she and her government believe that just by saying Make in India and chanting ‘Bharat Mata ki Jai’ they can cajole the rich to stay and invest in India.