Sitharaman reviews progress of LIC IPO

The government expects to garner anywhere between Rs 80,000 crore to Rs 100,000 crore by offloading 10% equity in the insurer

THC Bureau | January 8, 2022 6:44 pm

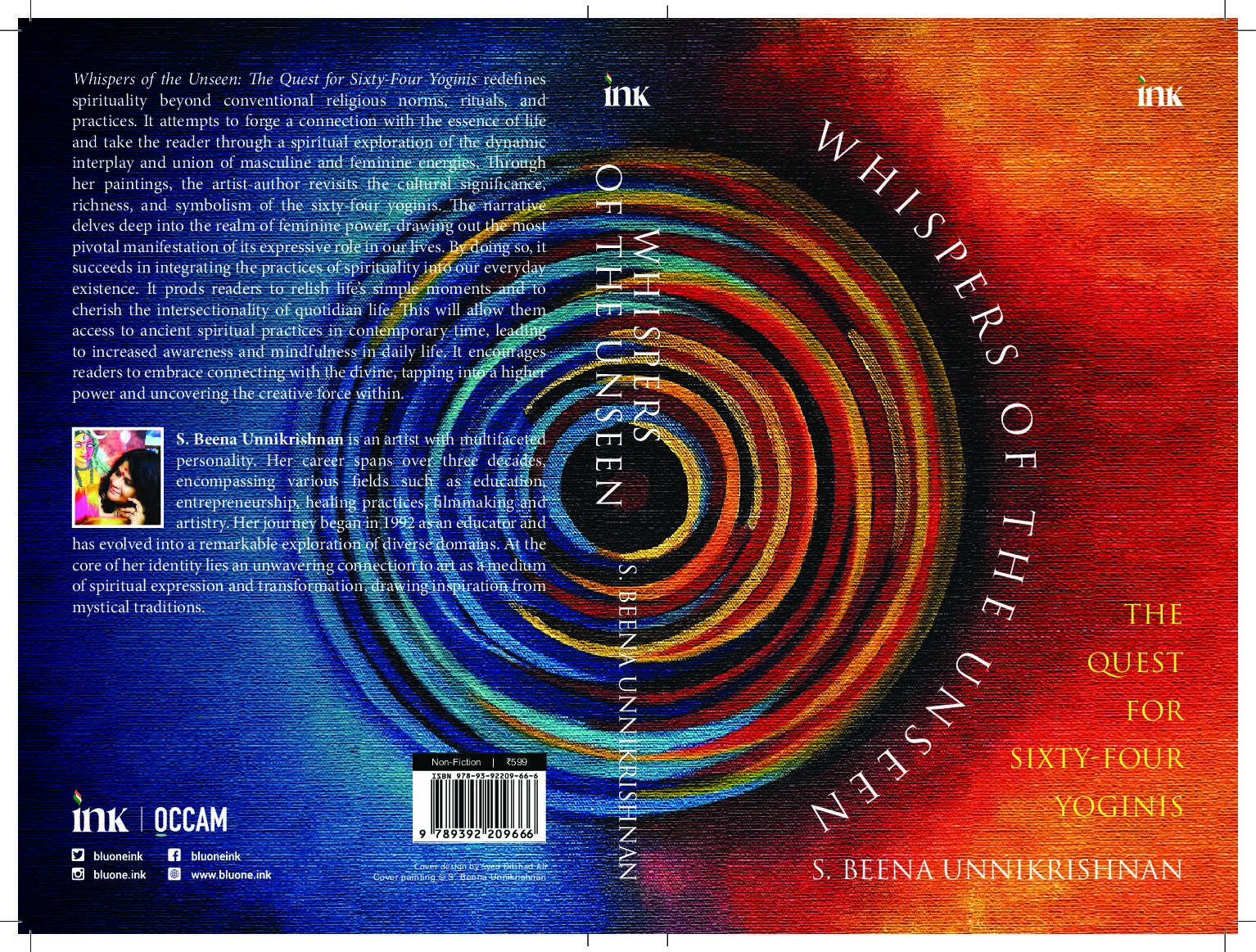

Finance Minister Nirmala Sitharaman (PIB)

Amid concerns that the mega initial public offering (IPO) of Life Insurance Corporation (LIC) may not hit the market before March 31, thus jeopardizing the government’s disinvestment target, Finance Minister Nirmala Sitharaman has yesterday reviewed the progress of the IPO launch.

“Union finane minister Smt. @nsitharaman reviewed progress of the LIC IPO in New Delhi today (Friday) in presence of @SecyDIPAM; Secretary @DFS_India and Senior Officials @LICIndiaForever and @FinMinIndia via VC,” the Finance Ministry tweeted.

In her Budget 2021-22, Sitharaman had fixed a target of Rs 1.75 lakh crore from disinvestment. However, the government has been able to garner just about 5 per cent of that.

The government had planned various kinds of disinvestment for 2021-22, including the LIC IPO and privatization of Air India, IDBI Bank Ltd, oil refining and marketing major Bharat Petroleum Corp, and helicopter services operator Pawan Hans Ltd.

The largest disinvestment, if and when it happens, will be LIC IPO. The insurer is expected to be valued anywhere between Rs 8 lakh crore to Rs 10 lakh crore, so if the government offloads even 10 per cent it can garner anywhere between Rs 80,000 crore to Rs 100,000 crore.

Doing valuation, however, is time consuming. This is the reason that, according to a PTI report, the IPO is unlikely happen this fiscal. The report said, “There are still some issues that need to be addressed with regard to the valuation of LIC, a senior official of one of the merchant bankers said. Even after the valuation, there are several regulatory processes that have concluded, the official said.”

The IPO has be vetted by the Securities and Exchange Board of India, or Sebi, and the Insurance Regulatory and Development Authority of India. To make the matter worse, the latter has been without a chief for seven months.

In July last year, the Narendra Modi government had okayed the listing of LIC. Soon after that 10 merchant bankers were appointed. The government also amended the Life Insurance Corporation Act, 1956, for the purpose. The amendment stipulates that the government will have to hold at least 75 per cent in the insurer for the first five years after the IPO, and later at least 51 per cent.

Sitharaman seems keen to bring out the LIC IPO, for without it the disinvestment target will be badly missed. In 2020-21 too, the government had failed to get anywhere near the Budgetary estimate of Rs 2.1-lakh crore disinvestment target. It just garnered Rs 32,835 crore.