Niti’s Amitabh Kant urges PE funds to invest in privatization

The most entrenched and dogged among the opponents of privatization are from the Sangh Parivar

Ravi Shanker Kapoor | March 22, 2021 2:07 pm

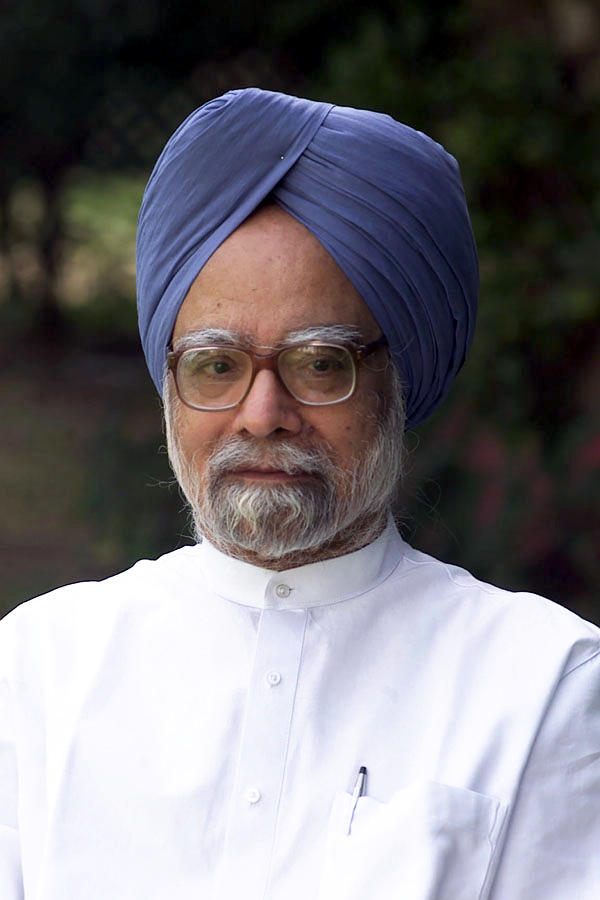

Niti Aayog Chief Executive Officer Amitabh Kant (Photo courtesy: https://commons.wikimedia.org)

Niti Aayog Chief Executive Officer Amitabh Kant recently said the Narendra Modi government’s privatization drive will create ample opportunities for the private equity industry to invest in. He is correct; in fact, the sale of public sector undertakings (PSUs) can help not just PE funds but also give a fillip to economic growth and development. But this will not be easy, for there are important interests and lobbies pitted against the selloff process.

Strange it may sound but the reality is that the most entrenched and dogged among the opponents of privatization are from the Sangh Parivar—a bunch of bodies that have made a tryst with obscurantism, benightedness, and baloney. So, a few weeks ago, the RSS-affiliated Bharatiya Mazdoor Sangh (BMS) announced a phased stir against the privatization.

The BMS’ PSUs Coordination Committee recently talked about “the onslaught of the government” on PSUs. Another RSS outfit, the Swadeshi Jagaran Manch (SJM), is also against the government’s disinvestment programme.

On the face of it, the RSS’ rhetoric may appear bogus, a shenanigan to keep its pro-worker image intact (For some esoteric reason, being against liberalization is regarded as pro-people and pro-worker). The truth, however, is that the saffron warriors are ideologically opposed to privatization; they have always been against it, as we shall see. So, they may not be feigning when they rail against the sale of PSUs.

It may be recalled that when the Bharatiya Janata Party-led government under Atal Bihari Vajpayee was selling off PSUs, it faced maximum resistance from the RSS, not the Left. The then RSS chief K. Sudarshan made it clear that he was against the free market policies adopted by the government. A cabinet member, George Fernandes, put his foot down over the issue of the privatization of BPCL and HPCL; he was fully supported by the RSS.

Even when the RSS and its functionaries couldn’t stop the sale of PSUs, they did obstruct the process. A prominent RSS ideologue, who is now on the board of the Reserve Bank of India, actively campaigned against privatization.

In a nutshell, it would be unwise to downplay the destructive role that the RSS can play in checking privatization in particular and liberalization in general.

The government is trying though. “Asset monetization and privatization are among a range of areas where private equity can come and create wealth for themselves,” Kant recently told an audience of private equity executives and family office managers during a virtual event organized by the Indian Private Equity and Venture Capital Association (https://economictimes.indiatimes.com/mf/mf-news/how-etfs-can-help-you-create-wealth-heres-a-series-to-explore-insights/articleshow/81592680.cms).

Hopefully, PE fund managers and venture capitalists will not be scared by the enemies of privatization. Kant and other government functionaries must ensure that.