Narendra Indira Modi checks ‘profiteering’

Ravi Shanker Kapoor | June 22, 2017 1:18 pm

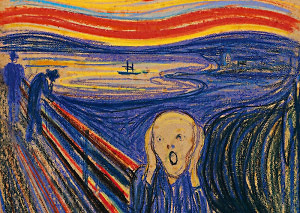

The anti-profiteering rules under the goods and services tax (GST) regime give the lie to the Narendra Modi government’s commitment to enhance the ease of doing business. Socialist—that is the only word to describe a dispensation that can go to the extent of threatening the cancellation of registration of companies on the grounds that they are charging higher prices from consumers.

The body to terrorize businesses is called the National Anti-Profiteering Authority (Napa). So now, the most despicable term ‘profiteering’ has a formal status, something that didn’t happen even during the dark ages before 1991. Headed by a secretary-level officer, it would comprise five members. It would be empowered to demand price reduction commensurate with the lowering of incidence of taxation under GST. It can also demand return of the undue profit earned from not passing on the reduction in incidence of tax to consumers along with an 18 per cent interest. In case there are no claimants, the money would go to the Consumer Welfare Fund.

Napa would also have the authority to impose penalties on non-compliant businessmen. And, of course, it could shut down the company if the need be.

Well, the good news is that the monster called Napa has been given a life span of two years but there is a caveat: it can be extended if, in its wisdom, the GST Council deems it fit. Another saving grace is that Napa is not allowed to act suo motu. Considerable bureaucratic rigmarole is needed to activate it; a state has to set up a screening committee to examine written complaints. The panel has to decide within two months. If prima facie it finds the complaint genuine, the matter would go to the Director General of Safeguards which will further examine.

“The Authority shall, within a period of three months from the date of receipt of the report from the Director General of Safeguards determine whether a registered person has passed on the benefit of reduction in rate of tax on the supply of goods or services or the benefit of input tax credit to the recipient by way of commensurate reduction in prices,” the rules said.

Finance Minister Arun Jaitely “hopes” that the government won’t be compelled to activate Napa. The Finance Minister is an honorable man, so he may remain honorable in his conduct in regards to Napa, but to assume that everybody in the system is honorable is being excessively credulous, indeed gullible. A bad legal or administrative provision cannot be tolerate on the grounds that the folks administering it would be honest and reasonable in doing so.

The Finance Minister, who is also a prominent lawyer, should also remember what the Supreme Court said two years ago. While striking down the draconian 66A of the Indian Penal Code, the apex court said, “If Section 66A is otherwise invalid, it cannot be saved by an assurance from the learned additional solicitor general that it will be administered in a reasonable manner. Governments may come and governments may go but Section 66A goes on forever. An assurance from the present Government even if carried out faithfully would not bind any successor Government. It must, therefore, be held that Section 66A must be judged on its own merits without any reference to how well it may be administered.”

Well, Napa is not mandated to stay forever, but it cannot be allowed to exist even for a brief period on the assurance of the goodness and fairness of the people administering it. Therefore, Napa should also be judged in the manner the SC judged Section 66A: “be on its own merits without any reference to how well it may be administered.”

In a nutshell, by bringing out Napa, the Modi government has carrying forward the legacy of Indira Gandhi, who imposed irrational economic regulations and the Emergency, rather than that of Syama Prasad Mukherjee, the founder of Modi’s party and a champion of freedom.