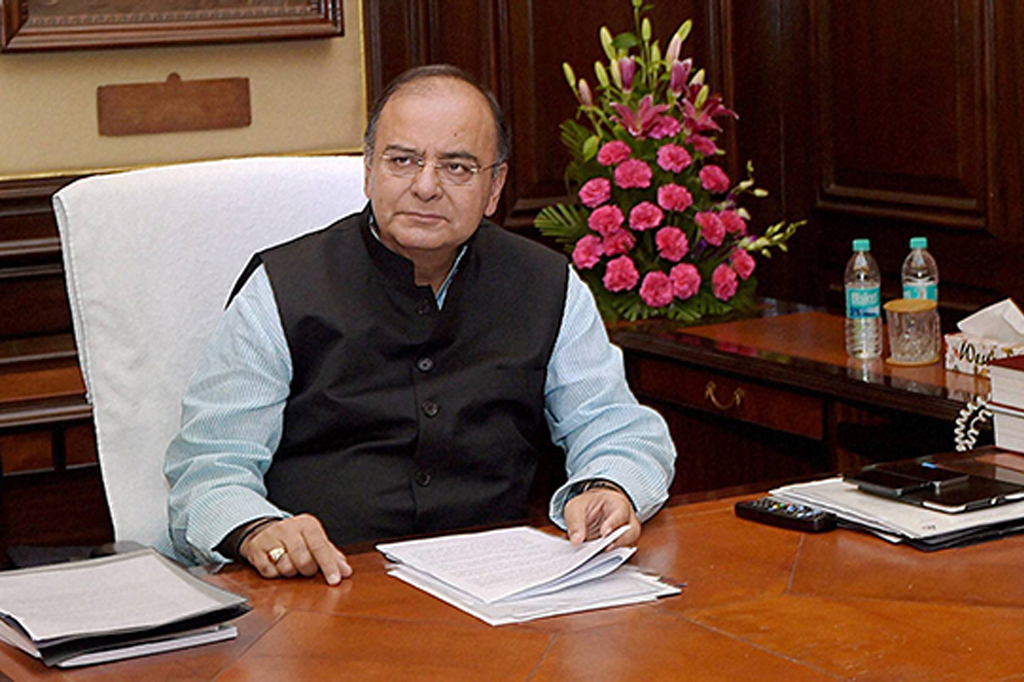

Jaitley plans to bleed PSUs

Ravi Shanker Kapoor | October 27, 2016 5:44 am

Finance Minister Arun Jaitley seems to be the repository of bad ideas, the latest one being burdening public sector undertakings (PSUs) like NTPC and SAIL with bad debts, euphemistically called non-performing assets (NPAs). Gross NPAs of public sector banks (PSBs) have ballooned to Rs 4.76 lakh crore in 2015-16 from Rs 2.67 lakh crore in the previous fiscal. NPAs are indeed a big problem, but the suggested solution to it is expected to become a bigger problem.

“This [roping in PSUs to manage NPAs] will necessarily involve the banks invoking their powers under the contract, converting a part of the debt into equity, taking control of those units and appointing a management team of established people from either current or retired representative who have great experience of those sectors,” Jaitley said on Monday after a meeting attended by the officials of his ministry and also by those from the Prime Minister’s Office.

Everything about the remedy on the block is wrong. First, profit-making PSUs are not necessarily the paragons of competence; often their profits are the result of monopoly or market dominance, a fact often pointed out in the reports of the Department of Public Enterprises and the Comptroller & Auditor General.

Second, even the well-run PSUs—or private companies, for that matter—do not have the competencies and skill-sets needed to revive sick or loss-making companies. Cambridge dictionary defines ‘turnaround management’ as “the management methods needed or used to change a failing organization into a successful one.” These are specialized methods and skills; every manager, howsoever efficient, is not familiar with them.

Third, turnaround is as much a science as an art; it needs not just the requisite expertise but also imagination, outside-the-box thinking, and nimble decision making. Our PSU managers, on the other hand, are known for unimaginative strategies, linear thinking, and flatfooted approach. It’s not their fault entirely, for such is the public sector culture. Apart from political interference and bureaucratic bottlenecks, such oversight mechanisms as the CVC, CAG, and CBI—the three C’s—make PSU bosses excessively cautious and thus un-businesslike. These indeed are some of the factors that are responsible for the bad performance of PSUs in general. Expecting turnaround excellence from them is like expecting our national football team to win the world cup.

And, finally, even if by some miracle our PSUs are able to redeem the NPAs of state-run lenders, it would be nationalization, the hallmark of socialism. You don’t promote a globally discredit, anti-business ideology and expect investors to queue up to invest in your country.

Yet, Jaitley is cocksure about his harebrained scheme. He has reportedly said that the Secretaries of the ministries concerned have been asked to coordinate between PSBs and the chiefs of PSUs concerned. “I think they will start immediately. The banks will invoke their power and somebody has to come up. Today one of the legitimate problems is whenever some asset is put out [for sale], there are no takers, so the takers will be created.”

Forced, not created; in the natural course, there would have been many buyers, even from PSUs. But now that there are few, the government would coerce them to shell out goodly sums to help out PSBs. But then what’s sauce for the goose is sauce for the gander: a PSB’s NPA would not metamorphose into a cash cow if a PSU takes it over. Especially when, as we just mentioned, the latter lacks turnaround management skills, which they lack.

The Finance Minister is either unaware of or has ignored the fact that PSUs are corporate entities, bound by not just the laws of the land but also by the rules and regulations of the three C’s. How would the forced purchases of stressed assets be justified to the CAG?

Quite apart from the financial loss, such purchases would also spell an unnecessary distraction for PSUs.

Besides, since both PSUs and PSBs are owned by the government, a transfer of liabilities from one to the other pointless.

This is not the first time that government has targeted the huge reserves of profit-making PSUs. In the 1990s, they were forced to indulge in cross-holdings—‘A’ PSU would buy the government stake in ‘B,’ and vice-versa. The government would get the money, the public sector nature of both companies remained unaltered, and unions and lal salaam-type intellectuals didn’t go mad with rage. It was the most pathetic and pusillanimous kind of disinvestment.

The real solution to NPAs and many other problems is privatization—of PSBs as well as of PSUs. Unfortunately, this is the solution neither the Finance Minister nor Prime Minister Narendra Modi is interested in.